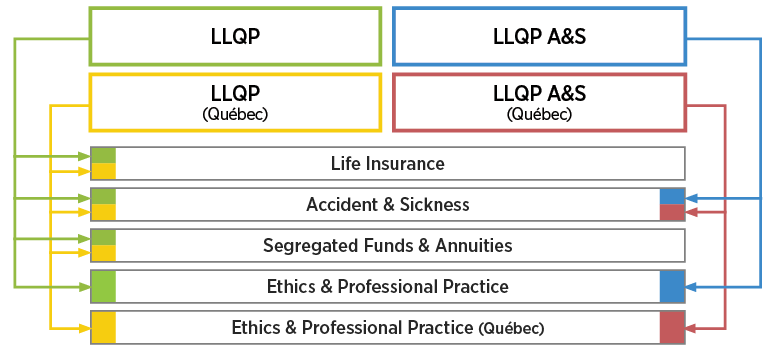

The first step in becoming licensed to offer insurance solutions to your clients is to successfully complete an approved Life License Qualification Program (LLQP). Recognized as one of the top programs leading to a first-time pass rate, the Advocis/Foran LLQP is the best choice to develop the product understanding to get your career underway.

An important outcome of this engagement may be the offering or selling of insurance or investment products that are put in place to implement recommendations and realize those plans. For this purpose, financial advisors are required to obtain a license from their provincial regulator.

Once you are registered into the Advocis/Foran LLQP, you must also register for the Canadian Insurance Participant Registry (CIPR). When you have passed all of your certification exams, your LLQP provider will update your CIPR account. Your insurance regulator will check your account to ensure you have met all requirements. Once confirmed, you will be eligible to write your provincial exams to obtain your license.