Advocis/Foran Life License Qualification Program – Accident & Sickness

The first step in becoming licensed in the area of accident and sickness is to successfully complete an approved Life License Qualification Program – Accident & Sickness. Recognized as one of the top programs leading to a first-time pass rate, the Advocis/Foran LLQP A&S is the best choice to develop the product understanding to get your career underway.

Designed as a self-study program, the Advocis/Foran LLQP is organized according to the specific learning areas the provincial regulator will test you on.

As you complete each module, you'll be able to test your knowledge with our series of self-test questions. Once you are ready to write your certification exam, use our Practice Exam Tool to assist you in your exam preparation.

Who Should Enrol?

- Anyone seeking a provincial life insurance license

Program Structure

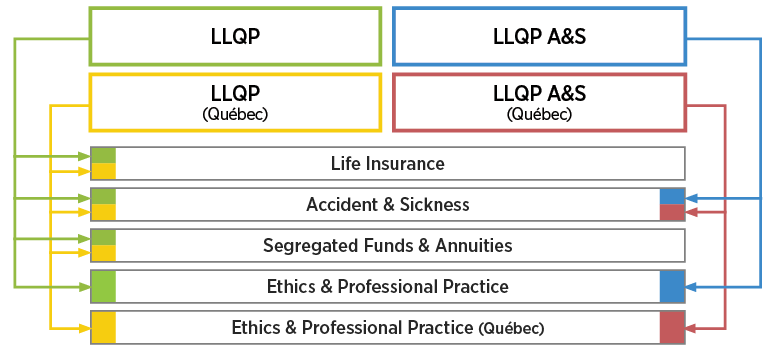

The Advocis/Foran LLQP – Accident & Sickness program consists of two modules as shown below (one of which is an ethics module). Each module has a corresponding modular certification exam, which must be completed with a minimum mark of 60 per cent. Once BOTH of the certification exams have been successfully completed, you will be eligible to write the two corresponding provincial exams to obtain your license.

Program Module

Accident & Sickness

The Accident & Sickness module provides the groundwork for recommending individual and group accident and sickness insurance products adapted to client needs and situation. Included in this module are needs analysis strategies, features and purposes of various A&S insurance products, methods for recommending appropriate insurance products to address client needs and approaches to providing ongoing client service.

- Learning Objectives

- Overview

- Features

- Delivery

- Price

- To examine the methods and processes used to assess and analyze client insurance needs, to present an insurance recommendation and to implement the insurance application

- To understand the advantages, disadvantages and benefits of disability, long term care and critical illness protection and health insurance products

- To explore underwriting concepts, criteria and processes that the insurer undertakes to confirm an applicant's eligibility for insurance coverage

- To consider the agent’s role in providing ongoing client service reviews, updates and processing claims

Format: Self-study: Online learning & certification exam

Pre-requisites: None

CE Credits: 30 (overall program)

Study Hours: 30

Additional Material: None

Completion Requirements:

- Passing mark is 60%

- Completion of one online modular certification exam (100% of overall module mark)

- One year window for completion

- Complimentary Advocis membership

- Robust Practice Exam Tool

- Tips tool provides further definitions or examples on key topics

- Robust Practice Exam Tool (PET) for extensive exam practice

- Digital flashcards to test your knowledge

- Keep track of your development with the User Progress tool

- Chapter quizzes

- Comprehensive glossary

- Case studies that offer practical application

- First certification exam attempt

- Detailed analysis of certification exam performance

- Access to the Binder tool

- Download PDF version of content

- Access to help for module-related questions

- ReadSpeaker text-to-speech tool

- Self-study: The Advocis/Foran online LLQP is designed as a self-study-program, with success highly dependent on the student's personal discipline. Students are encouraged to take advantage of the various tools this program offers (Tips, chapter quizzes, Practice Exam Tool) to enhance their learning.

- Instructor-led: Advocis has partnered with a number of institutions to offer this program in a classroom setting. Please click here for additional information on how to register for this program through one of our education partners.

Members & Non-members: $195.00 plus taxes

Note: The price listed above applies to the entire program and not for each module

Administrative Policies:

- Expiry date is one (1) year after registration

- Access to content is available for 60 days after passing the certification exam

- Allow for 1-2 business days to access the module following the registration and payment process

Ethics Modules

Students MUST choose one of the following two ethics modules to successfully complete the Advocis/Foran LLQP program. You also have the option to take both ethics modules should you want to be licensed in Québec and the rest of Canada.

Ethics & Professional Practice

The Ethics & Professional Practice module provides the groundwork for developing an ethical professional practice, in compliance with the rules governing the life insurance sector. Included in this module is an overview of the legal aspects of insurance and annuity contracts, a description of the rights and obligations of the parties to an insurance contract, an appraisal of the rules relating to the issue, operation and disposal of an individual or group insurance contract, an appreciation of the major provisions of individual and group insurance plans, and an assessment of the rules and practice obligations of insurance agents.

- Learning Objectives

- Overview

- Features

- Delivery

- CE Credits

- Price

- To understand the major legal principles that impact an agent's insurance practice

- To examine the operation of insurance and annuity contracts

- To understand and interpret the rules pertaining to claims, benefit payments, beneficiary designations and exemptions from seizure of benefits

- To explore the role of the organizations that protect clients and integrate into practice the obligations and responsibilities of life insurance agents

Format: Self-study: Online learning & certification exam

Pre-requisites: None

CE Credits: 30 (overall program)

Study Hours: 30

Additional Material: None

Completion Requirements:

- Passing mark is 60%

- Completion of one online modular certification exam (100% of overall module mark)

- One year window for completion

- Complimentary Advocis membership

- Robust Practice Exam Tool

- Tips tool provides further definitions or examples on key topics

- Robust Practice Exam Tool (PET) for extensive exam practice

- Digital flashcards to test your knowledge

- Keep track of your development with the User Progress tool

- Chapter quizzes

- Comprehensive glossary

- Case studies that offer practical application

- First certification exam attempt

- Detailed analysis of certification exam performance

- Access to the Binder tool

- Download PDF version of content

- Access to help for module-related questions

- ReadSpeaker text-to-speech tool

- Self-study: The Advocis/Foran online LLQP is designed as a self-study-program, with success highly dependent on the student's personal discipline. Students are encouraged to take advantage of the various tools this program offers (Tips, chapter quizzes, Practice Exam Tool) to enhance their learning.

- Instructor-led: Advocis has partnered with a number of institutions to offer this program in a classroom setting. Please click here for additional information on how to register for this program through one of our education partners.

Alberta Insurance Council: 15 Life, 15 A&S

Chambre de la Sécurité Financière: 5 Compliance, 5 General Subjects, 5 Insurance of Persons

Candidates seeking CE or PDU credits for professional designations or organizations (including The Institute™) should contact the governing body for confirmation of CE/PDU qualification.

Members & Non-members: $119.00 plus taxes

Note: The price listed above applies to the entire program and not for each module

Administrative Policies:

- Expiry date is one (1) year after registration

- Access to content is available for 60 days after passing the certification exam

- Allow for 1-2 business days to access the module following the registration and payment process

Ethics & Professional Practice (Québec)

The Ethics & Professional Practice (Québec) module provides the groundwork for developing an ethical professional practice, in compliance with the rules governing the life insurance sector. Included in this module is an overview of the Civil Code of Québec for insurance of persons representatives, a review of the legal aspects of insurance and annuity contracts, a description of the rights and obligations of the parties to an insurance contract, an appraisal of the rules relating to the issue, operation and disposal of an individual or group insurance contract, an appreciation of the major provisions of individual and group insurance plans, and an assessment of the rules and practice obligations of insurance representatives.

- Learning Objectives

- Overview

- Features

- Delivery

- CE Credits

- Price

- To understand the major legal principles that impact an agent's insurance practice including important sources of law, public insurance and pension plans

- To examine the operation of insurance and annuity contracts

- To understand and interpret the rules pertaining to claims, benefit payments, beneficiary designations and exemptions from seizure of benefits

Format: Self-study: Online learning & certification exam

Pre-requisites: None

CE Credits: 30 (overall program)

Study Hours: 30

Additional Material: None

Completion Requirements:

- Passing mark is 60%

- Completion of one online modular certification exam (100% of overall module mark)

- One year window for completion

- Complimentary Advocis membership

- Robust Practice Exam Tool

- Tips tool provides further definitions or examples on key topics

- Robust Practice Exam Tool (PET) for extensive exam practice

- Digital flashcards to test your knowledge

- Keep track of your development with the User Progress tool

- Chapter quizzes

- Comprehensive glossary

- Case studies that offer practical application

- First certification exam attempt

- Detailed analysis of certification exam performance

- Access to the Binder tool

- Download PDF version of content

- Access to help for module-related questions

- ReadSpeaker text-to-speech tool

- Self-study: The Advocis/Foran online LLQP is designed as a self-study-program, with success highly dependent on the student's personal discipline. Students are encouraged to take advantage of the various tools this program offers (Tips, chapter quizzes, Practice Exam Tool) to enhance their learning.

- Instructor-led: Advocis has partnered with a number of institutions to offer this program in a classroom setting. Please click here for additional information on how to register for this program through one of our education partners.

Alberta Insurance Council: 30 Life, 30 A&S

Chambre de la Sécurité Financière: 10 Compliance, 10 General Subjects, 10 Insurance of Persons

Candidates seeking CE or PDU credits for professional designations or organizations (including The Institute™) should contact the governing body for confirmation of CE/PDU qualification.

Members & Non-members: $119.00 plus taxes

Note: The price listed above applies to the entire program and not for each module

Administrative Policies:

- Expiry date is one (1) year after registration

- Access to content is available for 60 days after passing the certification exam

- Allow for 1-2 business days to access the module following the registration and payment process

Already Licensed?

Ethics & Professional Practice

The Ethics & Professional Practice (Québec) module is now offered on an individual basis for those who already have their license in Canada but would like to practice in Québec too. Similarly, the Ethics & Professional Practice module is also available for those who are licensed in Québec and want to practice in other provinces.

Accident & Sickness

If you already have your A&S license, you can now take the Life Insurance and Segregated Funds & Annuities modules together to become fully licensed.

Please contact Member Services for more details.