Chartered Life Underwriter® (CLU®) Designation

The Chartered Life Underwriter (CLU) designation has been widely recognized for 90 years as a superior mark of excellence in the financial services industry. Advocis is honored to be the education provider for this prestigious designation. CLU designation holders are regarded as elite professional financial advisors who specialize in developing effective solutions for individuals, business owners, and professionals in the areas of risk management, wealth creation and preservation, estate planning, and wealth transfer.

The CLU designation is conferred in Canada exclusively by The Institute for Advanced Financial Education ("The Institute"). The Institute is the leading designation body in Canada for financial services practitioners in the specialty areas of Advanced Estate and Wealth Transfer, and Living Benefits.

CLU Eligibility

Upon successful completion of the CLU program, you must apply to receive the designation. At the time of application you must attest to having completed at least four years of experience within, or related to, the financial services industry.

The experience requirement is inclusive of management, staff, academics, writers, candidates and volunteers engaged directly or indirectly within the financial services industry, as well as financial advisors

Who Should Enrol?

- Individuals looking to earn the highly regarded CLU designation in Canada

- Financial services professionals or specialists looking to help consumers build and preserve wealth through effective wealth creation, estate planning and wealth transfer solutions

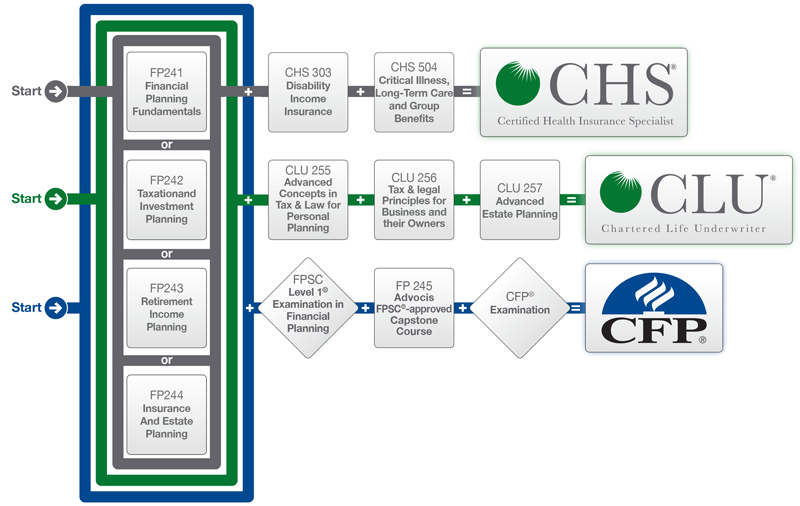

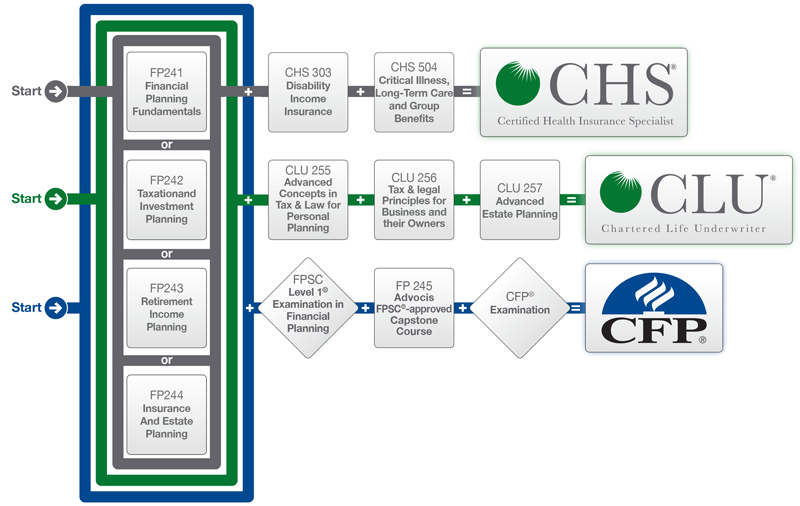

Pre-requisite Learning*

To enrol in the CLU Designation program candidates must have first successfully completed the following CFP® Designation courses.*

FP241 – Financial Planning Foundations

This course introduces the fundamentals of financial planning, and looks at concepts and applications associated with financial calculations and financial statement analysis. Contracting and family law basics are covered followed by a review of government-sponsored benefit programs.

- Learning Objectives

- Overview

- Features

- CE Credits

- Delivery

- Price

- To understand the concepts and applications associated with financial calculations and financial statement analysis, and the basic concepts of contracting and family law, and government sponsored benefit programs

Format: Self-study: online learning and testing

Pre-requisites: None

Additional Material: None

Completion Requirements:

- Passing mark is 60%

- Completion of five online module quizzes (30% of overall mark)

- Completion of one case study (10% of overall mark)

- Final online exam (60% of overall mark)

- 24/7 access to the Advocis Learning Centre

- Download the eBook version of the course content

- Robust Practice Tool

- 120-day window for completion

- First exam attempt

- Keep track of your development with the Class Progress tool

- Searchable glossary

- ReadSpeaker text-to-speech tool

Alberta Insurance Council: 30 Life, 30 A&S

Chambre de la Sécurité Financière: 5 Compliance, 10 General Subjects, 10 Insurance of Persons, 5 Group Savings Plan Brokerage

Candidates seeking CE or PDU credits for professional designations or organizations (including The Institute™) should contact the governing body for confirmation of CE/PDU qualification.

- Self-study: We recommend candidates create and follow a study schedule, and take advantage of the exercises, problems and case studies offered throughout the course. After each module test, candidates receive feedback on incorrect answers to advance their learning in preparation for the final exam.

- Instructor-led: Advocis and CCH have partnered with a number of post secondary institutions to offer our courses in a classroom setting. Please click here for additional information on how to register for this program through one of our education partners.

Members: $150.00

Non-members: $570.00 plus shipping & taxes

Administrative Policies:

- Course duration is 120 days

- A two month extension can be purchased for a fee

- Allow for 1-2 business days to access the course following the registration and payment process

FP242 – Taxation and Investment Planning

This course begins with an introduction to basic income tax laws, followed by a more advanced study of tax planning in the context of both personal and business situations. Candidates will gain an in-depth knowledge of various business structures, and evaluate those structures from a legal, tax, and financial planning perspective. Additionally, the course includes a thorough discussion of investment products including investments in stocks, bonds, mutual funds, exchange traded funds, and segregated funds as well as the application of those products in various investment strategies.

- Learning Objectives

- Overview

- Features

- CE Credits

- Delivery

- Price

- To identify, analyze, interpret and evaluate tax situations using income tax terminology and general tax concepts including types of income and deductions, non-refundable tax credits and clawback provisions

- To understand, explain and apply extensive applications relative to capital gains including types of property, adjusted cost base, deemed dispositions, recapture of CCA and terminal loss rules

- To identify, explain and apply an in-depth knowledge of different forms of organizations including a sole proprietorship, partnership, and corporation

Format: Self-study: online learning and testing

Pre-requisites: None

Additional Material: None

Completion Requirements:

- Passing mark is 60%

- Completion of five online module quizzes (30% of overall mark)

- Completion of one case study (10% of overall mark)

- Final online exam (60% of overall mark)

- 24/7 access to the Advocis Learning Centre

- Download the eBook version of the course content

- Robust Practice Tool

- 120-day window for completion

- First exam attempt

- Keep track of your development with the Class Progress tool

- Searchable glossary

- ReadSpeaker text-to-speech tool

Accreditation details for this course will be available in August 2017.

- Self-study: We recommend candidates create and follow a study schedule, and take advantage of the exercises, problems and case studies offered throughout the course. After each module quiz, candidates receive feedback on incorrect answers to advance their learning in preparation for the final exam.

- Instructor-led: Advocis and CCH have partnered with a number of post secondary institutions to offer our courses in a classroom setting. Please click here for additional information on how to register for this program through one of our education partners.

Members: $200.00 plus shipping & taxes

Non-members: $570.00 plus shipping & taxes

Administrative Policies:

- Course duration is 120 days

- A 2 month extension can be purchased for a fee

- Allow for 1-2 business days to access the course following the registration and payment process

FP243 – Retirement Income Planning

This course is designed to provide candidates with a detailed understanding of the principles and applications related to retirement income planning. Candidates will develop an in-depth knowledge of government benefit programs such as the Canada Pension Plan and Old Age Security, as well as employer-sponsored registered plans such as defined benefit and defined contribution pension plans. Finally, the course provides a comprehensive analysis of Registered Retirement Savings Plans and Registered Retirement Income Funds within the context of retirement planning and establishing retirement goals and objectives.

- Learning Objectives

- Overview

- Features

- CE Credits

- Delivery

- Price

- To understand the products, issues and practices of managing risk

- To consider aspects of retirement planning and the application of various retirement plan vehicles to meet retirement planning objectives

Format: Self-study: online learning and testing

Pre-requisites: None

Additional Material: None

Completion Requirements:

- Passing mark is 60%

- Completion of five online module quizzes (30% of overall mark)

- Completion of one case study (10% of overall mark)

- Final online exam (60% of overall mark)

- 24/7 access to the Advocis Learning Centre

- Download the eBook version of the course content

- Robust Practice Tool

- 120-day window for completion

- First exam attempt

- Keep track of your development with the Class Progress tool

- Searchable glossary

- ReadSpeaker text-to-speech tool

Alberta Insurance Council: 30 Life

Chambre de la Sècuritè Financiére: 10 Insurance of Persons, 10 Group Insurance of Persons, 10 Group Savings Plan Brokerage.

Candidates seeking CE or PDU credits for professional designations or organizations (including The Institute™) should contact the governing body for confirmation of CE/PDU qualification.

- Self-study: We recommend candidates create and follow a study schedule, and take advantage of the exercises, problems and case studies offered throughout the course. After each module quiz, candidates receive feedback on incorrect answers to advance their learning in preparation for the final exam.

- Instructor-led: Advocis and CCH have partnered with a number of post secondary institutions to offer our courses in a classroom setting. Please click here for additional information on how to register for this program through one of our education partners.

Members: $250.00 plus shipping & taxes

Non-Members: $570.00 plus shipping & taxes

Administrative Policies:

- Course duration is 120 days

- A two month extension can be purchased for a fee

- Allow for 1-2 business days to access the course following the registration and payment process

FP244 – Insurance and Estate Planning

This course begins with legal fundamentals and the basics of family law, including the implications of relationship breakdown, support obligations, and title to property. Risk management fundamentals are discussed in the context of life, living benefits, and property and casualty insurance. Candidates will gain a working knowledge of the advantages, disadvantages, and income tax implications of various insurance products. The course concludes with an estate planning discussion including the use of trusts, wills, powers of attorney, and concepts and principles related to the taxation of a deceased taxpayer.

- Learning Objectives

- Overview

- Features

- CE Credits

- Delivery

- Price

- To understand the fundamentals important to the topics of economics and investing as they relate to key areas of financial planning

- To examine a broad array of investment products and explores the subject of personal financial management

- To consider estate planning fundamentals, concepts and applications to the financial planning process

Format: Self-study: online learning and testing

Pre-requisites: None

Additional Material: None

Completion Requirements:

- Passing mark is 60%

- Completion of four online module quizzes (30% of overall mark)

- Completion of one case study (10% of overall mark)

- Final online exam (60% of overall mark)

- 24/7 access to the Advocis Learning Centre

- Download the eBook version of the course content

- Robust Practice Tool

- 120-day window for completion

- First exam attempt

- Keep track of your development with the Class Progress tool

- Searchable glossary

- ReadSpeaker text-to-speech tool

Alberta Insurance Council: 30 Life, 30A&S

Chambre de la Sècuritè Financiére: 10 General Subject, 10 Insurance of Persons, 5 Group Insurance of Persons.

Candidates seeking CE or PDU credits for professional designations or organizations (including The Institute™) should contact the governing body for confirmation of CE/PDU qualification.

- Self-study: We recommend candidates create and follow a study schedule, and take advantage of the exercises, problems and case studies offered throughout the course. After each module quiz, candidates receive feedback on incorrect answers to advance their learning in preparation for the final exam.

- Instructor-led: Advocis and CCH have partnered with a number of post secondary institutions to offer our courses in a classroom setting. Please click here for additional information on how to register for this program through one of our education partners.

Members: $250.00 plus shipping & taxes

Non-Members: $570.00 plus shipping & taxes

Administrative Policies:

- Course duration is 120 days

- A 2 month extension can be purchased for a fee

- Allow for 1-2 business days to access the course following the registration and payment process

* Please be advised that individuals with the following designations are exempted from completing the Pre-requisite Learning:

- PFP

- FP Canada Level 1 Certificate

- CFP

- F.Pl. (Pl.Fin.)

- CPA

- CFA

- CMA

- CGA

- CA

To enrol in the CLU, please send a current-dated Letter in Good Standing to info@advocis.ca.

Please note: Changes are being made to the Advocis CFP® Certification Program

Advocis is updating the Advocis CFP Certification program in response to changes initiated by FP Canada.

The new FP Canada Body of Knowledge curriculum requires Advocis to modify our CFP certification program, as the four courses we currently offer will need to bereorganized into Core and Advanced programs.

Aligning with FP Canada's Body of Knowledge curriculum, the Advocis CFP Certification Program (Core Topics) will be offered as 12 distinct modules.

Beginning in 2020, Advocis will offer an Advanced Topics program consisting of one course and one final exam.

Please visit our FAQs to find out more.

For more information on this and other changes visit the FP Canada website

Core Courses

CLU candidates must successfully complete all three core courses to earn the CLU Designation.

Please note: An eBook of all course content is available for courses 255 and 256. A printed study guide is included with registration for course 257.

255 – Advanced Concepts in Tax & Law for Personal Planning

This course focuses on wealth transfer and estate planning strategies for individuals and families. Descriptions of law and tax structures lead to discussions on applicable financial planning approaches for individuals and families.

- Learning Objectives

- Overview

- Features

- CE Credits

- Delivery

- Price

- The use of life insurance and living benefits to manage personal risks and wealth preservation

- The creation of trusts and other instruments to ensure the orderly transfer of individual wealth

- The examination of the special tax reporting obligations facing individuals who enter or leave Canada

- The examination of client objectives and responsibilities at death including tax and legal obligations and how they can be reconciled to the wealth transfer and estate planning intentions of the testator

Format: Self-study: online learning and testing

Pre-requisites: FP241-244

Additional Material:

Completion Requirements:

- Passing mark is 60%

- Completion of four online module quizzes (40% of overall mark)

- Final online exam (60% of overall mark)

- 24/7 access to the Advocis Learning Centre

- Download the eBook version of the course content

- Robust Practice Quiz Tool

- 120-day window for completion

- First exam attempt

- Keep track of your development with the User Progress tool

- Searchable glossary

- Access to Binder

- Access to help for course-related questions

- ReadSpeaker text-to-speech tool

Alberta Insurance Council: 30 Life

Insurance Council of Manitoba : 30

Chambre de la Sécurité Financière: 15 General Subjects, 15 Insurance of Persons

Candidates seeking CE or PDU credits for professional designations or organizations (including The Institute™) should contact the governing body for confirmation of CE/PDU qualification.

- Self-study: We recommend candidates take advantage of the Practice Quiz Tool to prepare them for the module quizzes and final exam. After each module quiz, candidates receive feedback on incorrect answers to advance their learning in preparation for the final exam.

- Instructor-led: Advocis has partnered with a number of post-secondary institutions to offer our courses in a classroom setting. Please click here for additional information on how to register for this program through one of our education partners.

Members: $450.00 plus shipping & taxes

Non-members: $795.00 plus shipping & taxes

Administrative Policies:

- Course duration is 120 days

- A two month extension can be purchased for a fee

- Allow one to two business days to access the course following the registration and payment process

256 – Tax & legal Principles for Business and their Owners

This course focuses on wealth transfer and estate planning strategies for businesses and business owners.

- Learning Objectives

- Overview

- Features

- CE Credits

- Delivery

- Price

- A description of the legal and tax implications of certain business structures, specifically sole proprietorships, partnerships and corporations with particular attention to tax planning strategies and the issues to be addressed at the sale or transfer of the business or at the death of a principle

- A special focus on the tax complexities present in the operation of a corporation

- The approaches to identify, apply and synthesize appropriate income tax techniques used to restructure a corporation

- The consideration of planning strategies for the orderly and tax-efficient of business wealth at retirement or upon death

Format: Self-study: online learning and testing

Pre-requisites: FP241-244 & CLU255

Additional Material:

Completion Requirements:

- Passing mark is 60%

- Completion of four online module quizzes (40% of overall mark)

- Final online exam (60% of overall mark)

- 24/7 access to the Advocis Learning Centre

- Download the eBook version of the course content

- Robust Practice Quiz Tool

- 120-day window for completion

- First exam attempt

- Keep track of your development with the User Progress tool

- Searchable glossary

- Access to Binder

- Access to help for course-related questions

- ReadSpeaker text-to-speech tool

Alberta Insurance Council: 30 Life

Insurance Council of Manitoba : 30

Candidates seeking CE or PDU credits for professional designations or organizations (including The Institute™) should contact the governing body for confirmation of CE/PDU qualification.

- Self-study: We recommend candidates take advantage of the Practice Quiz Tool to prepare them for the module quizzes and final exam. After each module quiz, candidates receive feedback on incorrect answers to advance their learning in preparation for the final exam.

- Instructor-led: Advocis has partnered with a number of post-secondary institutions to offer our courses in a classroom setting. Please click here for additional information on how to register for this program through one of our education partners.

Members: $450.00 plus shipping & taxes

Non-members: $795.00 plus shipping & taxes

Administrative Policies:

- Course duration is 120 days

- A two month extension can be purchased for a fee

- Allow for one-two business days to access the course following the registration and payment process

257 – Advanced Estate Planning

This course is the culmination of all the courses in the CLU program. The course is designed to help financial advisors hone their skills in working with the client to develop a comprehensive estate plan that addresses all of the client's objectives and obligations.

- Learning Objectives

- Overview

- Features

- CE Credits

- Delivery

- Price

- To analyze the client's financial status and overall estate planning objectives

- To explain the advantages and disadvantages of different estate planning strategies and contrast them with one another

- To consider planning strategies involving the use of inter vivos and testamentary trusts

- To assess the need for life insurance in order to support the estate plan and recommend alternative insurance strategies

Format: Self-study: Printed study guide, online assignment submission & proctored paper-based narrative response exam

Pre-requisites: FP241-244 & CLU255-256

Required Textbooks:

- Wealth Planning Strategies for Canadians, Christine Van Cauwenberghe, 2019 Edition, $73.00 plus shipping & taxes

- Estate Planning with Life Insurance, Glenn R. Stephens, 6th Edition, $83.85 plus shipping & taxes

Completion Requirements:

- Passing mark is 60%

- Completion of two written assignments (40% of overall mark)

- Final open-book, case-based narrative response proctored exam (60% of overall mark)

Note: You must score a minimum of 50% on the final exam in order to pass.

Winter 2020 (registration opens December 1, 2019 and closes January 15, 2020)

| Course Requirement |

% of Overall Course Mark |

Deadline |

| Assignment 1 |

20% |

Feb. 15, 2020 |

| Assignment 2 |

20% |

Mar. 15, 2020 |

| Final Exam |

60% |

April 29, 2020 |

Questions?

Please visit our FAQ page for more details.

For any other questions, please contact Member Services.

- 24/7 access to the Advocis Learning Centre

- Self-test questions and case studies

- Access to the Binder tool

- Access to help for course-related questions

- ReadSpeaker text-to-speech tool

Alberta Insurance Council: 30 Life

Insurance Council of Manitoba : 30

Chambre de la Sécurité Financière: 15 General Subjects, 15 Insurance of Persons

Candidates seeking CE or PDU credits for professional designations or organizations (including The Institute™) should contact the governing body for confirmation of CE/PDU qualification.

- Self-study: We recommend candidates create and follow a study schedule, and take advantage of the review tests offered throughout the course. After each assignment, candidates receive feedback on incorrect responses to advance their learning in preparation for the final exam.

- Instructor-led: Advocis and CCH have partnered with a number of post-secondary institutions to offer our courses in a classroom setting. Please click here for additional information on how to register for this program through one of our education partners.

Members: $550.00 plus shipping & taxes

Non-members: $850.00 plus shipping & taxes

Administrative Policies:

- Course is offered on a semester basis

- A re-write or re-enrollment can be purchased for a fee

- Allow for 1-2 business days to access the course following the registration and payment process