Advocis is a proud founding member of the FP Canada™, which was established in November 1995 with the core mission of "promoting and enforcing professional standards in financial planning through the CERTIFIED FINANCIAL PLANNER® DESIGNATION, and raising Canadians' awareness of the importance of financial planning." Advocis continues to support and uphold this commitment to promoting competency and ethical standards among financial advisors and planners.

CFP designation holders, highly regarded for their ability to provide clients with comprehensive financial planning services, put clients' interests first and ensure clients' financial needs and objectives are fulfilled through the financial planning process. For more information, please visit the FP Canada website.

|

Please Note:

Changes are being made to the Advocis CFP® Certification Program

Please visit our FAQs to find out more. For more information on the CFP program and other changes visit the FP Canada website |

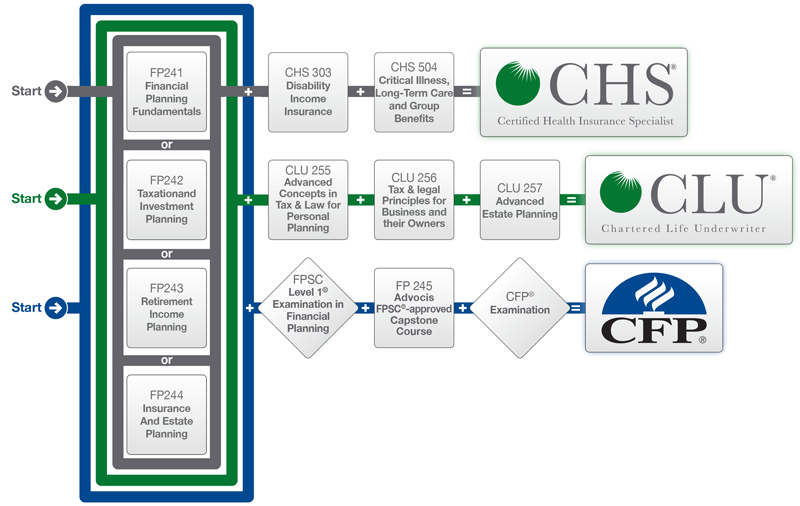

Individuals who successfully complete Advocis' four core curriculum courses and the Capstone course meet the educational requirements on the path to the CFP designation.

This course introduces the fundamentals of personal financial planning. Candidates will be expected to acquire an understanding of the concepts and applications associated with time value of money financial calculations and the analysis of personal financial statements. In addition, the course includes an analysis of government sponsored programs such as Registered Education Savings Plans and Tax Free Savings Accounts. This course concludes with a discussion of the fundamentals of economics and investing as they relate to key areas of financial planning.

Format: Self-study: online learning and testing

Pre-requisites: None

Additional Material: None

Completion Requirements:

Alberta Insurance Council: 30 Life, 30 A&S

Chambre de la Sécurité Financière: 5 Compliance, 10 General Subjects, 10 Insurance of Persons, 5 Group Savings Plan Brokerage

Candidates seeking CE or PDU credits for professional designations or organizations (including The Institute™) should contact the governing body for confirmation of CE/PDU qualification.

Members: $150.00

Non-members: $570.00 plus shipping & taxes

Administrative Policies:

This course begins with an introduction to basic income tax laws, followed by a more advanced study of tax planning in the context of both personal and business situations. Candidates will gain an in-depth knowledge of various business structures, and evaluate those structures from a legal, tax, and financial planning perspective. Additionally, the course includes a thorough discussion of investment products including investments in stocks, bonds, mutual funds, exchange traded funds, and segregated funds as well as the application of those products in various investment strategies.

Format: Self-study: online learning and testing

Pre-requisites: None

Additional Material: None

Completion Requirements:

Alberta Insurance Council: 30 Life

Chambre de la Sècuritè Financiére: 10 General Subjects, 10 Insurance of Persons

Candidates seeking CE or PDU credits for professional designations or organizations (including The Institute™) should contact the governing body for confirmation of CE/PDU qualification.

Members: $200.00 plus shipping & taxes

Non-members: $570.00 plus shipping & taxes

Administrative Policies:

This course is designed to provide candidates with a detailed understanding of the principles and applications related to retirement income planning. Candidates will develop an in-depth knowledge of government benefit programs such as the Canada Pension Plan and Old Age Security, as well as employer-sponsored registered plans such as defined benefit and defined contribution pension plans. Finally, the course provides a comprehensive analysis of Registered Retirement Savings Plans and Registered Retirement Income Funds within the context of retirement planning and establishing retirement goals and objectives.

Format: Self-study: online learning and testing

Pre-requisites: None

Additional Material: None

Completion Requirements:

Alberta Insurance Council: 30 Life

Chambre de la Sècuritè Financiére: 10 Insurance of Persons, 10 Group Insurance of Persons, 10 Group Savings Plan Brokerage.

Candidates seeking CE or PDU credits for professional designations or organizations (including The Institute™) should contact the governing body for confirmation of CE/PDU qualification.

Members: $250.00 plus shipping & taxes

Non-members: $570.00 plus shipping & taxes

Administrative Policies:

This course begins with legal fundamentals and the basics of family law, including the implications of relationship breakdown, support obligations, and title to property. Risk management fundamentals are discussed in the context of life, living benefits, and property and casualty insurance. Candidates will gain a working knowledge of the advantages, disadvantages, and income tax implications of various insurance products. The course concludes with an estate planning discussion including the use of trusts, wills, powers of attorney, and concepts and principles related to the taxation of a deceased taxpayer.

Format: Self-study: online learning and testing

Pre-requisites: None

Additional Material: None

Completion Requirements:

Alberta Insurance Council: 30 Life, 30A&S

Chambre de la Sècuritè Financiére: 10 General Subject, 10 Insurance of Persons, 5 Group Insurance of Persons.

Candidates seeking CE or PDU credits for professional designations or organizations (including The Institute™) should contact the governing body for confirmation of CE/PDU qualification.

Members: $250.00 plus shipping & taxes

Non-members: $570.00 plus shipping & taxes

Administrative Policies:

This course focuses on preparing a modular and comprehensive financial plan on an FP Canada-approved case study that follows the six-step financial planning process and addresses the competencies laid out in the CFP Professional Competency Profile. Candidates are expected to apply the knowledge gained through the Advocis CFP Certification Program to develop a comprehensive financial plan that addresses the objectives of a hypothetical client.

Note: The Modular Plan and Comprehensive Plans are based on an FP Canada Case. Candidates must purchase this case separately through the FP Canada website.

Format: Self-study: Printed study guide, online testing, assignments & discussion forums

Pre-requisites: FP241 to 244

Additional Material:

Completion Requirements:

Summer 2019 (registration opens June 1, 2019 and closes July 17, 2019)

| Assignment | % of Overall Course Mark | Deadline |

| Completion of modular plan | 20% | August 7, 2019 |

| Completion of comprehensive plan | 50% | September 30, 2019 |

| Participation in online ethics discussion forum | 10% | First posting: August 12, 2019, Second and third posting: September 3, 2019 |

| Completion of four online module quizzes | 20% | October 15, 2019 |

Completion of each component is mandatory in order to pass the course.

Alberta Insurance Council: 30 Life

Chambre de la Sécurité Financière: 5 Compliance, 10 Insurance of Persons, 10 Group Insurance of Persons, 5 Group savings plan brokerage

Candidates seeking CE or PDU credits for professional designations or organizations (including The Institute™) should contact the governing body for confirmation of CE/PDU qualification.

Members: $390.00 plus shipping & taxes (FP Canada case study not included)

Non-members: $800.00 plus shipping & taxes (FP Canada case study not included)

Administrative Policies:

Note: The Modular Plan and Comprehensive Plans are based on an FP Canada Case. Candidates must purchase this case separately through the FP Canada website.

For more information on the path to CFP certification, please visit the FP Canada website.

Note: CERTIFIED FINANCIAL PLANNER® and  are certification trademarks owned outside the U.S. by Financial Planning Standards Board Ltd. (FPSB). Financial Planning Standards Council is the marks licensing authority for the CFP marks in Canada, through agreement with FPSB. To be authorized by FP Canada to use the CFP marks, individuals must complete additional examination, experience and ethics requirements.

are certification trademarks owned outside the U.S. by Financial Planning Standards Board Ltd. (FPSB). Financial Planning Standards Council is the marks licensing authority for the CFP marks in Canada, through agreement with FPSB. To be authorized by FP Canada to use the CFP marks, individuals must complete additional examination, experience and ethics requirements.