Certified Health Insurance Specialist® (CHS®) Designation

The Certified Health Insurance Specialist (CHS) designation was established in 2011 by The Institute for Advanced Financial Education (The Institute) to raise the bar on professional standards and practice methods of financial advisors in the health insurance sector, and to provide designation holders with expertise in this specialized field.

Please note: Existing CHS candidates who have not completed their elective course please contact Member Services at info@advocis.ca

Advocis is proud to be the education provider for the CHS — the only health insurance focused designation in Canada — which strategically positions financial advisors to meet the growing market demand for informed living benefits advice.

The CHS designation is conferred exclusively by The Institute, the leading designation body in Canada for financial services practitioners in the specialty areas of Advanced Estate and Wealth Transfer, and Living Benefits.

Who Should Enrol?

- Individuals looking to earn the only health-insurance focused designation in Canada

- Financial services professionals or specialists looking to provide expertise in income replacement, critical illness, long-term care, disability and group benefits

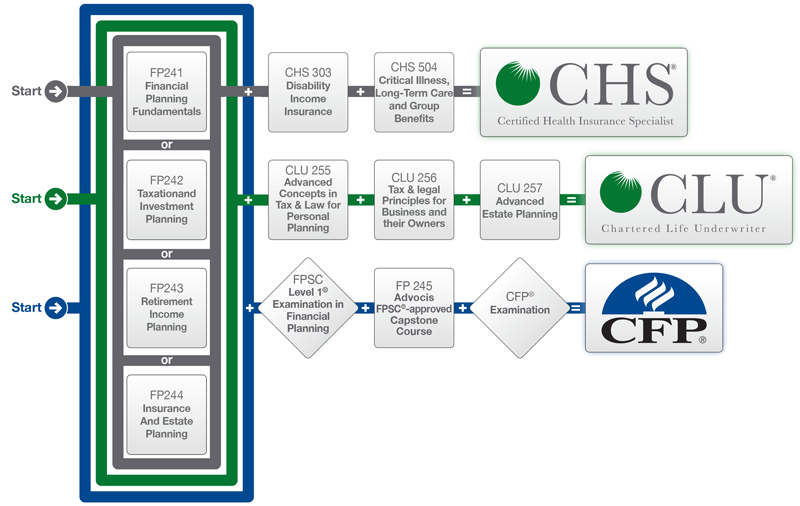

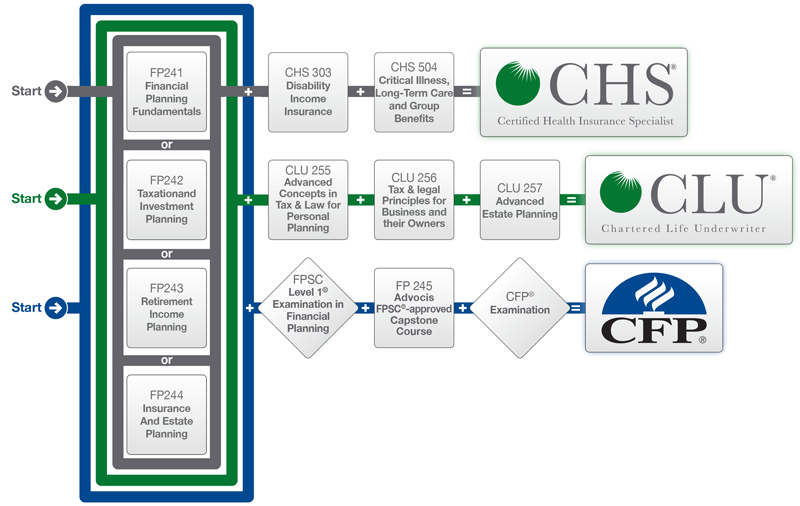

Core Courses

CHS candidates must successfully complete both core courses to earn the CHS Designation.

Please note: An eBook of the study guide is available for courses 303 and 504.

303 – Disability Income Insurance – Individual & Group

This course provides a comprehensive description of the living benefits programs and products that address disability and health risks for individuals in personal and business situations. Topics include the nature of the disability insurance risk, disability insurance policy provisions, head office product design and pricing, and special risk products for disability insurance.

- Learning Objectives

- Overview

- Features

- CE Credits

- Delivery

- Price

- To understand the unique moral, physical and legal hazards associated with disability insurance, your clients' risk of disability in personal and business settings, and the importance of addressing this issue with them

- To identify, analyze and explain the common provisions of a typical disability income policy including optional coverage benefits

- To identify and perform the various steps associated with classifying occupations, and preparing the application for head office underwriting

- To understand the factors affecting the disability claims process

Format: Self-study: Online learning & testing

Pre-requisites: None

Required Textbook:

- Disability Insurance and Other Living Benefits, Jacqueline Figas, 3rd Edition, $69.95 plus shipping & taxes

Completion Requirements:

- Passing mark is 60%

- Completion of four online module quizzes (40% of overall mark)

- Final online exam (60% of overall mark)

- 24/7 access to the Advocis Learning Centre

- Download the eBook version of the course content

- Robust Practice Quiz Tool

- 120-day window for completion

- First exam attempt

- Searchable glossary

- Access to the Binder tool

- Access to help for course-related questions

- ReadSpeaker text-to-speech tool

Alberta Insurance Council: 30 A&S

Chambre de la Sécurité Financière: 10 Compliance, 30 General Subjects, 10 Insurance of Persons, 10 Group Insurance

Candidates seeking CE or PDU credits for professional designations or organizations (including The Institute™) should contact the governing body for confirmation of CE/PDU qualification.

- Self-study: We recommend candidates create and follow a study schedule, and take advantage of the Practice Quiz Tool to prepare them for the module quizzes and final exam. After each module quiz, candidates receive feedback on incorrect answers to advance their overall learning.

- Instructor-led: Advocis and CCH have partnered with a number of post-secondary institutions to offer our courses in a classroom setting. Please click here for additional information on how to register for this program through one of our education partners.

Members: $320.00 plus shipping & taxes

Non-members: $595.00 plus shipping & taxes

Administrative Policies:

- Course duration is 120 days

- A 2 month extension can be purchased for a fee

- Allow for 1-2 business days to access the course following the registration and payment process

504 – Critical Illness, Long-term Care & Group Living Benefits

This course provides a comprehensive review of two special living benefits products – critical illness and long-term care, while considering key topics such as product design, pricing, marketing, underwriting and claims. Group living benefits are examined within the context of providing protection to employees in the workplace, short-term and long-term disability insurance, dental and health insurance, and flexible benefit as well as employee assistance programs.

- Learning Objectives

- Overview

- Features

- CE Credits

- Delivery

- Price

- To appreciate the unique challenges around the design and pricing of CI products, underwriting applications for critical illness, and the importance of the advisor's role

- To consider the need for advanced planning with clients regarding their short- and long-term care needs

- To distinguish between different forms of LTC insurance and explain the differences in considering the challeges facing aging clients

- To appreciate the complexities of group plan design, administration, underwriting and claims adjudication

Format: Self-study: Online learning & testing

Pre-requisites: None

Required Textbooks:

- Group Benefits Plan Management, Ann O'Neil, 2015 Edition, Members: $74.95 plus shipping & taxes | Non-members: $99.95 plus shipping & taxes

- The Aging Client and Long-Term Care, Jacqueline E. Figas, 3rd Edition, $69.95 plus shipping & taxes

Completion Requirements:

- Passing mark is 60%

- Completion of six online module quizzes (40% of overall mark)

- Final online exam (60% of overall mark)

- 24/7 access to the Advocis Learning Centre

- Download the eBook version of the course content

- Robust Practice Quiz Tool

- 120-day window for completion

- First exam attempt

- Searchable glossary

- Access to the Binder tool

- Access to help for course-related questions

- ReadSpeaker text-to-speech tool

Alberta Insurance Council: 30 A&S

Chambre de la Sécurité Financière: 10 Compliance, 30 General Subjects, 10 Insurance of Persons, 10 Group Insurance

Candidates seeking CE or PDU credits for professional designations or organizations (including The Institute™) should contact the governing body for confirmation of CE/PDU qualification.

- Self-study: We recommend candidates create and follow a study schedule, and take advantage of the Practice Quiz Tool to prepare them for the module quizzes and final exam. After each module quiz, candidates receive feedback on incorrect answers to advance their overall learning.

- Instructor-led: Advocis and CCH have partnered with a number of post-secondary institutions to offer our courses in a classroom setting. Please click here for additional information on how to register for this program through one of our education partners.

Members: $320.00 plus shipping & taxes

Non-members: $595.00 plus shipping & taxes

Administrative Policies:

- Course duration is 120 days

- A 2 month extension can be purchased for a fee

- Allow for 1-2 business days to access the course following the registration and payment process

Elective Courses *

CHS candidates must successfully complete one of the following elective courses in the Advocis CFP® Certification Program* to earn the CHS Designation. Candidates that already have either the CFP or CLU designations and are in good standing are exempted from the elective.

*Please note: Advocis is updating the Advocis CFP Certification program in response to changes initiated by FP Canada that will come into effect January 2020.

The CHS currently includes an elective based on a choice of 1 of the 4 CFP core curriculum courses. The last date to enroll in the FP241-244 courses is August 31, 2019 and courses must be completed by December 31, 2019.

With the modularization of the CFP core curriculum, this will change January 2020 to a defined group of modules: 01 –Financial Planning Profession & Financial Services Industry Regulation, 02—Financial Analysis, 03—Credit & Debt, 05—Government Benefits, and 12—Human Behaviour. These modules were selected to compliment/enhance the CHS designation learning program.

FP241 — Financial Planning Foundations

This course introduces the fundamentals of personal financial planning. Candidates will be expected to acquire an understanding of the concepts and applications associated with time value of money financial calculations and the analysis of personal financial statements. In addition, the course includes an analysis of government sponsored programs such as Registered Education Savings Plans and Tax Free Savings Accounts. This course concludes with a discussion of the fundamentals of economics and investing as they relate to key areas of financial planning.

- Learning Objectives

- Overview

- Features

- CE Credits

- Delivery

- Price

- Understand the concepts and applications associated with time value of money financial calculations and develop the ability to accurately analyze personal financial statements

- Assimilate the financial planning process and understand its role in the financial services sector

Format: Self-study: online learning and testing

Pre-requisites: None

Additional Material: None

Completion Requirements:

- Passing mark is 60%

- Completion of five online module quizzes (30% of overall mark)

- Completion of one case study (10% of overall mark)

- Final online exam (60% of overall mark)

- 24/7 access to the Advocis Learning Centre

- Download the eBook version of the course content

- Robust Practice Tool

- 120-day window for completion

- First exam attempt

- Keep track of your development with the Class Progress tool

- Searchable glossary

- ReadSpeaker text-to-speech tool

Alberta Insurance Council: 30 Life, 30 A&S

Chambre de la Sécurité Financière: 5 Compliance, 10 General Subjects, 10 Insurance of Persons, 5 Group Savings Plan Brokerage

Candidates seeking CE or PDU credits for professional designations or organizations (including The Institute™) should contact the governing body for confirmation of CE/PDU qualification.

- Self-study: We recommend candidates create and follow a study schedule, and take advantage of the exercises, problems and case studies offered throughout the course. After each module quiz, candidates receive feedback on incorrect answers to advance their learning in preparation for the final exam.

- Instructor-led: Advocis has partnered with a number of post secondary institutions to offer our courses in a classroom setting. Please click here for additional information on how to register for this program through one of our education partners.

Members: $150.00

Non-members: $570.00 plus shipping & taxes

Administrative Policies:

- Course duration is 120 days

- A 2 month extension can be purchased for a fee

- Allow for 1-2 business days to access the course following the registration and payment process

FP242 — Taxation and Investment Planning

This course begins with an introduction to basic income tax laws, followed by a more advanced study of tax planning in the context of both personal and business situations. Candidates will gain an in-depth knowledge of various business structures, and evaluate those structures from a legal, tax, and financial planning perspective. Additionally, the course includes a thorough discussion of investment products including investments in stocks, bonds, mutual funds, exchange traded funds, and segregated funds as well as the application of those products in various investment strategies.

- Learning Objectives

- Overview

- Features

- CE Credits

- Delivery

- Price

- Acquire an in-depth knowledge of personal and business taxation within the context of financial planning

- Gain a thorough understanding of investment products, including stocks, bonds, mutual funds, exchange traded funds and segregated funds

Format: Self-study: online learning and testing

Pre-requisites: None

Additional Material: None

Completion Requirements:

- Passing mark is 60%

- Completion of five online module quizzes (30% of overall mark)

- Completion of one case study (10% of overall mark)

- Final online exam (60% of overall mark)

- 24/7 access to the Advocis Learning Centre

- Download the eBook version of the course content

- Robust Practice Tool

- 120-day window for completion

- First exam attempt

- Keep track of your development with the Class Progress tool

- Searchable glossary

- ReadSpeaker text-to-speech tool

Accreditation details for this course will be available in August 2017.

- Self-study: We recommend candidates create and follow a study schedule, and take advantage of the exercises, problems and case studies offered throughout the course. After each module quiz, candidates receive feedback on incorrect answers to advance their learning in preparation for the final exam.

- Instructor-led: Advocis has partnered with a number of post secondary institutions to offer our courses in a classroom setting. Please click here for additional information on how to register for this program through one of our education partners.

Members: $200.00 plus shipping & taxes

Non-members: $570.00 plus shipping & taxes

Administrative Policies:

- Course duration is 120 days

- A 2 month extension can be purchased for a fee

- Allow for 1-2 business days to access the course following the registration and payment process

FP243 — Retirement Income Planning

This course is designed to provide candidates with a detailed understanding of the principles and applications related to retirement income planning. Candidates will develop an in-depth knowledge of government benefit programs such as the Canada Pension Plan and Old Age Security, as well as employer-sponsored registered plans such as defined benefit and defined contribution pension plans. Finally, the course provides a comprehensive analysis of Registered Retirement Savings Plans and Registered Retirement Income Funds within the context of retirement planning and establishing retirement goals and objectives.

- Learning Objectives

- Overview

- Features

- CE Credits

- Delivery

- Price

- Acquire a detailed understanding of the principles and applications related to retirement income planning

- Develop an in-depth knowledge of government benefit programs such as the Canada Pension Plan and Old Age Security, as well as employer-sponsored registered plans such as defined benefit and defined contribution pension plans

Format: Self-study: online learning and testing

Pre-requisites: None

Additional Material: None

Completion Requirements:

- Passing mark is 60%

- Completion of five online module quizzes (30% of overall mark)

- Completion of one case study (10% of overall mark)

- Final online exam (60% of overall mark)

- 24/7 access to the Advocis Learning Centre

- Download the eBook version of the course content

- Robust Practice Tool

- 120-day window for completion

- First exam attempt

- Keep track of your development with the Class Progress tool

- Searchable glossary

- ReadSpeaker text-to-speech tool

Alberta Insurance Council: 30 Life

Chambre de la Sècuritè Financiére: 10 Insurance of Persons, 10 Group Insurance of Persons, 10 Group Savings Plan Brokerage.

Candidates seeking CE or PDU credits for professional designations or organizations (including The Institute™) should contact the governing body for confirmation of CE/PDU qualification.

- Self-study: We recommend candidates create and follow a study schedule, and take advantage of the exercises, problems and case studies offered throughout the course. After each module quiz, candidates receive feedback on incorrect answers to advance their learning in preparation for the final exam.

- Instructor-led: Advocis has partnered with a number of post secondary institutions to offer our courses in a classroom setting. Please click here for additional information on how to register for this program through one of our education partners.

Members: $250.00 plus shipping & taxes

Non-members: $570.00 plus shipping & taxes

Administrative Policies:

- Course duration is 120 days

- A 2 month extension can be purchased for a fee

- Allow for 1-2 business days to access the course following the registration and payment process

FP244 – Insurance and Estate Planning

This course begins with legal fundamentals and the basics of family law, including the implications of relationship breakdown, support obligations, and title to property. Risk management fundamentals are discussed in the context of life, living benefits, and property and casualty insurance. Candidates will gain a working knowledge of the advantages, disadvantages, and income tax implications of various insurance products. The course concludes with an estate planning discussion including the use of trusts, wills, powers of attorney, and concepts and principles related to the taxation of a deceased taxpayer.

- Learning Objectives

- Overview

- Features

- CE Credits

- Delivery

- Price

- Assimilate the legal fundamentals and the basics of family law, including the implications of relationship breakdown, support obligations, and title to property

- Gain a working knowledge of the advantages, disadvantages, and income tax implications of various insurance products

- Develop a thorough understanding of the use of trusts, wills, powers of attorney, and concepts and principles related to the taxation of a deceased taxpayer

Format: Self-study: online learning and testing

Pre-requisites: None

Additional Material: None

Completion Requirements:

- Passing mark is 60%

- Completion of four online module quizzes (30% of overall mark)

- Completion of one case study (10% of overall mark)

- Final online exam (60% of overall mark)

- 24/7 access to the Advocis Learning Centre

- Download the eBook version of the course content

- Robust Practice Tool

- 120-day window for completion

- First exam attempt

- Keep track of your development with the Class Progress tool

- Searchable glossary

- ReadSpeaker text-to-speech tool

Alberta Insurance Council: 30 Life, 30A&S

Chambre de la Sècuritè Financiére: 10 General Subject, 10 Insurance of Persons, 5 Group Insurance of Persons.

Candidates seeking CE or PDU credits for professional designations or organizations (including The Institute™) should contact the governing body for confirmation of CE/PDU qualification.

- Self-study: We recommend candidates create and follow a study schedule, and take advantage of the exercises, problems and case studies offered throughout the course. After each module quiz, candidates receive feedback on incorrect answers to advance their learning in preparation for the final exam.

- Instructor-led: Advocis has partnered with a number of post secondary institutions to offer our courses in a classroom setting. Please click here for additional information on how to register for this program through one of our education partners.

Members: $250.00 plus shipping & taxes

Non-members: $570.00 plus shipping & taxes

Administrative Policies:

- Course duration is 120 days

- A 2 month extension can be purchased for a fee

- Allow for 1-2 business days to access the course following the registration and payment process

* Please be advised that individuals with the following designations are exempted from completing the elective course:

- PFP

- FP Canada Level 1 Certificate

- CFP

- F.Pl. (Pl.Fin.)

- CPA

- CFA

- CMA

- CGA

- CA

Once you have completed the Course Courses for the CHS, please send a current-dated Letter in Good Standing (for your designation) to info@advocis.ca with your request to apply for the CHS designation.